New data from Wurl reveals renewed growth in viewership for FAST channels. But monetization challenges remain, particularly for those outside the top tier.

Top News Stories

· Philo adds HBO Max and Discovery+, and a big price increase (1:30)

· Operator-programmer disputes continue with YouTube TV (8:30)

Wurl data shows growth in the FAST market (14:40)

Wurl has consolidated data from the many FAST channels it manages for customers in its CTV Trends Report 2025: Advertiser Edition. It shows strong growth for FASTs, challenges in monetization, and presents an opportunity for advertisers to increase their investment in the market.

Over the last year, Wurl reports that the number of monthly active households watching FAST channels has increased by 12%. Over the same period, the average time people spend watching has also increased by 16%. Combining the two increases shows that the total hours of viewing (HOV) across all channels was up by almost 30% year over year.

On the negative side, Wurl reports that the number of channels watched remained relatively unchanged, at around 3 to 4 channels. This is disappointing, especially considering that the number of channels continues to increase. For example, Pluto TV claims to have over 2000 channels available worldwide, and continues to add new ones. In October, US viewers will find 11 new channels available, and viewers in Europe will be able to watch Pluto Snooker 900 starting October 6th.

If the number of channels watched hasn’t changed but the number of hours of viewing has gone up, people must be spending more time on the channels they use. Wurl claims that the time people spend watching the channels they follow has increased by 25% over the last year.

TiVo is releasing its Q2 2025 Video Trends Report on Wednesday, October 1st. I will be moderating a discussion of some of the report’s high points with TiVo executives at 11 AM Pacific Time that day. You can hear TiVo’s findings on the growth trends in the FAST market at that time. The webinar is free to attend. For paid subscribers to nScreenMedia on Substack, a piece comparing Wurl’s data with TiVo’s extensive North American survey data will publish at noon Pacific Time.

TiVo’s Q2 2025 Video Trends Report shows that FAST usage has increased in Canada and the US over the same period last year. The report states that the number of respondents who reported using at least one FAST service increased by 8% to 69.9%. The number of respondents using FASTs is catching SVOD users, which stands at 87%. TiVo survey participants also reported a dramatic increase in the number of channels they watch, from 5 to 9.

Ad fill rates have fallen (22:30)

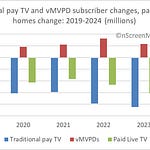

While viewership of channels is up, ad fill rates are down, according to Wurl. The company compared fill rates to those in January 2021 and found that, after experiencing 50% or more increases in fill rates in several months of 2021 and 2022, rates have declined in some cases to levels not seen since January 2021.

The company suggests one reason for the decline is that the supply of ad units is increasing faster than demand. There are several reasons to believe this is the case:

· The 30% increase in hours of viewing

· Huge growth in the number of FAST channels

· More FAST platforms entering the market.

More headwinds for smaller channel providers (29:30)

Specialty channels are not only dealing with lower fill rates, but also competition from the FAST platforms they rely on to reach their audience.

News is increasingly important to FAST growth (32:00)

TiVo data indicates that news has become increasingly important to the success of FAST services over the last year.